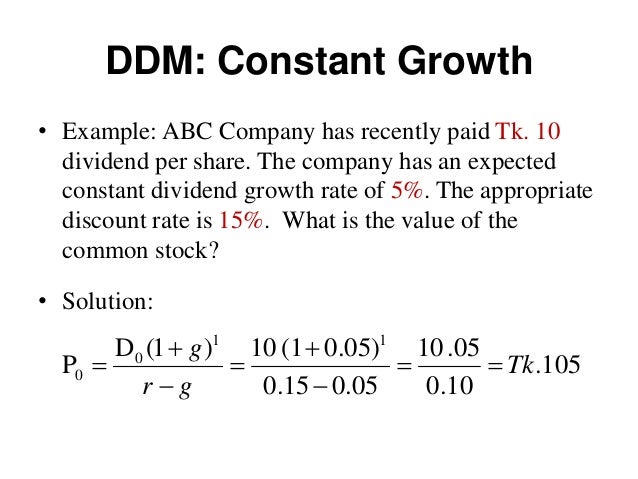

The horizontal bar for 00 up to 05 includes the days that the Funds market price matched its NAV that is there was no premium or discount so the premiumdiscount percentage equaled zero. The Constant Dividend Growth Model determines the price by analyzing the future value of a stream of dividends that grows at a constant rate.

Nike A Quick And Realistic Dividend Discount Model Nyse Nke Seeking Alpha

Dividend Discount Model Ddm Of Stock Valuation

Dividend Discount Model In Financial Analysis By Dobromir Dikov Fcca Magnimetrics Medium

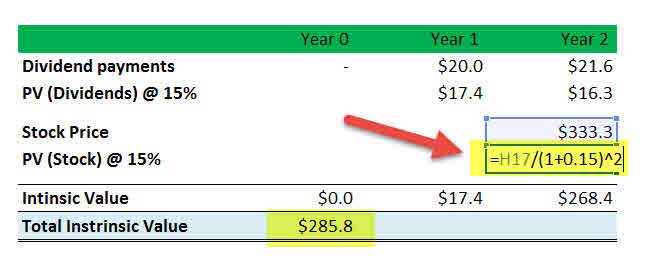

Valuing a firm with the two-stage dividend discount model.

Dividend discount model. The dividend valuation model is often referred to as the dividend discount model. To determine the value of a stock this valuation model uses future dividends to create a prediction on share values. The market rate of discount applicable to the company is 125.

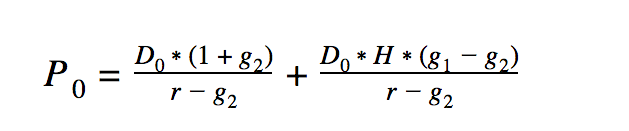

Gordon growth model is a type of dividend discount model in which not only the dividends are factored in and discounted but also a growth rate for the dividends is factored in and the stock price is calculated based on that. The model is very similar to the two-stage dividend discount model. The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value.

In other words DDM is used to value stocks based on the net present value of the future dividendsThe constant-growth form of the DDM is sometimes. What is the Gordon Growth Model. The dividends are the free cash flow since thats the cash that we as investors get.

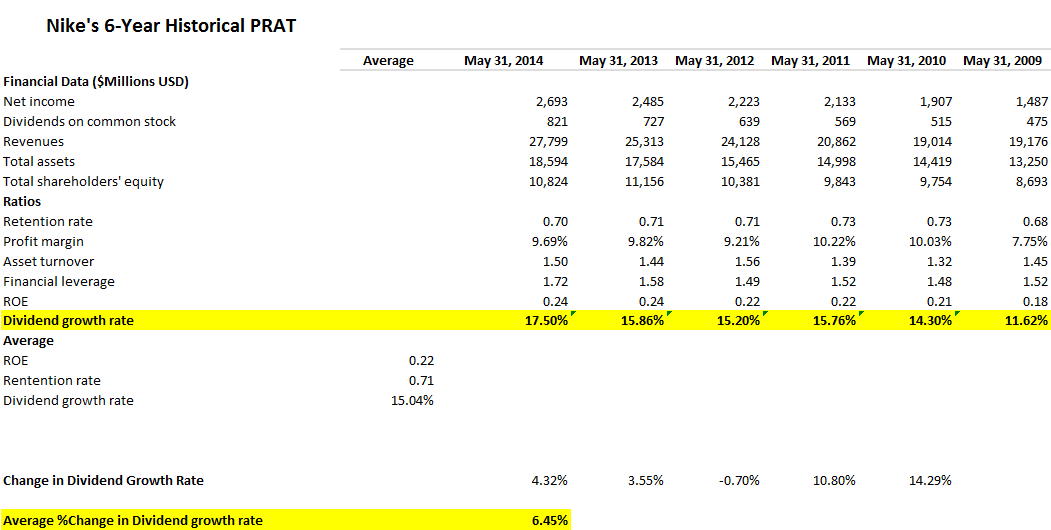

Shareholders who own shares before the ex-dividend date will receive the next dividend payment. At this stage the dividend payout tends to grow faster than the rate of inflation for successful companies. American Express A Rationale for using the Model Why two-stage.

Dividends are future cash flows for investors. Here we also discuss the introduction to Dividend Policy and factors affect along with types and importance. While American Express is a large financial service firm in a competitive market place normally not a candidate for above-stable growth it has gone through an extended period of depressed earnings.

As per the Gordon growth Formula Gordon Growth Formula Gordon Growth Model derives a companys intrinsic value if an investor. The Gordon Model includes the growth rate of dividends into the share price model. Dividend Discount Model DDM is a method valuation of a companys stock which is driven by the theory that the value of its stock is the cumulative sum of all its payments given in the form of dividends which we discount in this case to its present value.

The dividend discount model DDM is a quantitative method used for predicting the price of a companys stock based on the theory that its present-day price is worth the sum of all of its future. When a corporation earns a profit or surplus it is able to pay a proportion of the profit as a dividend to shareholders. Dividend Discount Model Calculator You can use this Dividend Discount Model DDM Calculator to quickly and easily estimate the true value of a stock using the dividend discount approach.

The second method I use is the dividend discount model. In simple words it is a way of valuing a company based on the theory that a stock is worth the discounted sum of all of its future dividend payments. Then a company decides which shareholders will receive a dividend.

However to avoid any emotional decisions which can be detrimental to your portfolio you should establish investing rules. The model can be used to estimate the value of a stock for which dividend payments are expected to remain constant for a long period in the future. The H-model is a quantitative method of valuing a companys stock price.

A company has an EPS of Rs. Two popular strategies are Dividend Investing and Index Investing. Constant Growth Dividend Valuation Model.

A dividend is a distribution of profits by a corporation to its shareholders. The dividend discount model works off the idea that the fair value of an asset is the sum of its future cash flows discounted back to fair value with an appropriate discount rate. You may also have a look at the following articles to learn more Dividend Growth Rate.

See my 7 Rules of Dividend Investing as an example. Estimating dividend growth on top of todays payout minus a discount rate leaves you with a theoretical reasonable value. In the company-wide example.

In finance and investing the dividend discount model DDM is a method of valuing the price of a companys stock based on the fact that its stock is worth the sum of all of its future dividend payments discounted back to their present value. It is based on the sole idea that investors are purchasing that stock to receive dividends. Each bar in the chart shows the number of trading days in which the Fund traded within the premiumdiscount range indicated.

This is the dividend declaration date. Calculate the market price of the share using Walters model. The dividend discount model assumes that a stock price reflects the present value of all future dividend payments.

In essence the dividend discount model is a simple method to calculate stock prices and it uses a formula that doesnt require a lot of input variables compared to other formulas. First a company declares they are paying a dividend. This model is used when a companys dividend payments are expected to grow at.

The DDM is a stock valuation technique that determines the present value of a stock in relation to the dividends it is expected to yield. However it differs in that it attempts to smooth out the growth rate over time rather than abruptly changing from the high growth period to the stable growth period. Once setup with your discount broker you need to decide on your investment strategy.

One very popular model explicitly relating the market value of the firm to dividend policy is developed by Myron Gordon. Retained earnings can be reinvested at IRR of 10. Overview Of The 4 Step Dividend Payment Process.

Any amount not distributed is taken to be re-invested in the business called retained earningsThe current year profit as well as the retained earnings of previous years are available for. The idea is to treat an individual share as one little free cash flow machine. The company is paying out Rs5 as a dividend.

However its dividend growth slowed in the 2015 fiscal year making a one-stage dividend discount model unsuitable for accurate valuation. By assuming that the discount rate K is constant Walters model abstracts from the effect of risk on the value of the firm. This is a guide to the Dividend Policy.

This example will use PGs 7 dividend growth rate for 2011-2014 in the first part of the formula and the 2015 growth rate of. The dividend discount model assumes a stocks fair value is the value of future dividend payments. Dividend Discount Model also known as DDM in which stock price is calculated based on the probable dividends that will be paid and they will be discounted at the expected yearly rate.

Introduction to Dividend Discount Model. Here D 5 E 15 k 125 r 10. The dividend discount model was developed under the assumption that the intrinsic value Intrinsic Value The intrinsic value of a business or any investment security is the present value of all expected future cash flows discounted at the appropriate discount rate.

The H Dividend Discount Model Dividend Com

Applying The Dividend Discount Model To Cisco Systems

Dividend Discount Model Formula And Examples Of Ddm

Dividend Discount Model In Financial Analysis By Dobromir Dikov Fcca Magnimetrics Medium

Dividend Discount Model Ddm Constant Growth Dividend Discount Model How To Value Stocks Youtube

1

Dividend Discount Valuation Model For Stocks Formula Example Investing Post

Dividend Discount Model Formula Example Guide To Ddm